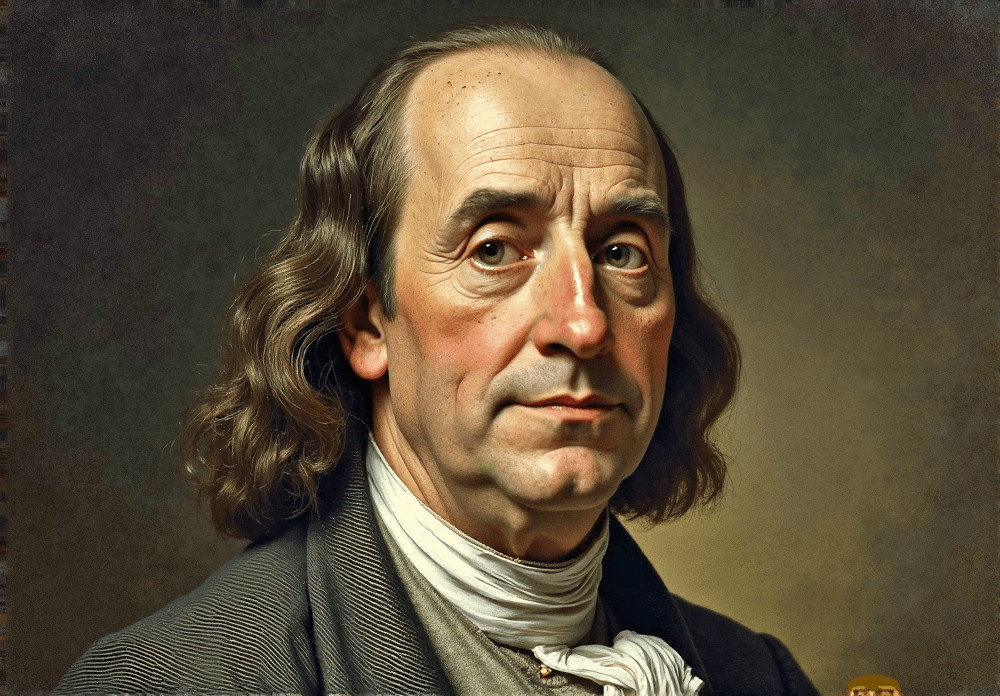

Timeless Wisdom for Modern Real Estate: Lessons from Benjamin Franklin

Benjamin Franklin, a Founding Father, renowned polymath, and astute businessman, offered insights that remain strikingly relevant to today’s real estate landscape. His wisdom, encapsulated in pithy quotes, provides a framework for navigating the complexities of property acquisition, management, and investment. Franklin’s understanding of value, risk, and long-term planning transcended his time, offering invaluable lessons for modern real estate enthusiasts. This article delves into some of Franklin’s most impactful pronouncements, exploring their practical application in the modern market and offering actionable advice for both buyers and sellers. From negotiating the best deal to managing a property for optimal returns, Franklin’s principles resonate with the core tenets of real estate investing, property management, financial planning, and savvy homeownership.

Franklin’s emphasis on diligence and informed decision-making is particularly crucial in today’s complex market. “Diligence is the mother of good luck,” he famously stated. For real estate investors, this translates to thorough due diligence, encompassing market analysis, property inspections, and financial projections. Understanding the local market dynamics, including rental rates, vacancy rates, and potential appreciation, is fundamental to successful property investment. Property management, too, demands diligence, from tenant screening and lease agreements to routine maintenance and rent collection. Neglecting these essential aspects can quickly erode profitability and long-term value. For homeowners, diligence applies to everything from securing a favorable mortgage rate to understanding the nuances of homeowner’s insurance and property taxes.

Financial planning is another area where Franklin’s wisdom shines. “A penny saved is a penny earned,” he wisely observed. This principle of frugality is paramount in real estate, where unforeseen expenses can quickly derail even the most carefully laid plans. Buyers should meticulously budget for not only the mortgage payment but also closing costs, property taxes, insurance, and ongoing maintenance. Creating a financial cushion for unexpected repairs is essential for both homeowners and investors. Sellers, too, benefit from financial prudence, carefully weighing the costs of staging, agent commissions, and potential price reductions to maximize their net proceeds. Negotiation tactics also play a critical role in real estate transactions. Franklin’s diplomatic skills were legendary, and his approach to negotiation emphasized fairness and mutual benefit. Whether negotiating a purchase price, lease terms, or contractor fees, a well-prepared and respectful approach can yield significant advantages.

Finally, Franklin’s appreciation for time as a valuable asset is directly applicable to real estate. “Lost Time is never found again,” he cautioned. In the fast-paced real estate market, timing is often critical. Buyers who hesitate in a competitive market may miss out on desirable properties, while sellers who delay listing their homes may face a less favorable market environment. Recognizing market trends and acting decisively can significantly impact the outcome of a real estate transaction. For investors, time is a crucial factor in calculating return on investment, as holding costs and market fluctuations can influence profitability. By embracing Franklin’s principles of knowledge, frugality, preparation, and time management, individuals can navigate the complexities of the real estate market with greater confidence and achieve their financial goals.

Knowledge is Key: Investing in Real Estate Expertise

“An investment in knowledge pays the best interest,” a principle that resonates deeply within the complex world of real estate. In today’s dynamic real estate market, continuous learning is not just beneficial; it’s a necessity for both aspiring homeowners and seasoned real estate investors. For those looking to buy a home, this means more than just browsing listings; it requires a deep dive into neighborhood demographics, understanding local school ratings, and comparing mortgage rates from multiple lenders. Furthermore, understanding property valuations, including the nuances of comparable sales data, is crucial to avoid overpaying. This foundational knowledge is the bedrock of sound financial planning in real estate, aligning with Benjamin Franklin’s emphasis on prudence and informed decision-making.

For sellers, the landscape demands equal diligence. Analyzing real estate market trends, such as days-on-market and price-per-square-foot fluctuations, is essential for strategic pricing. Optimizing property presentation through staging and professional photography can significantly enhance a listing’s appeal, while understanding negotiation tactics enables sellers to secure the best possible terms. Effective property management, even for a single home, starts with understanding the local market and its unique demands. For example, a seller in a rapidly appreciating market might consider a more aggressive pricing strategy, while one in a slower market may need to focus more on property upgrades and buyer incentives.

Expanding on the concept of ‘knowledge as an investment,’ consider the realm of real estate investing. Savvy investors don’t just rely on hunches; they immerse themselves in market analysis, understanding cap rates, cash-on-cash returns, and the intricacies of various investment strategies, such as fix-and-flips or buy-and-hold properties. They also recognize the importance of due diligence, thoroughly vetting potential properties and understanding local regulations. This level of financial wisdom, informed by data and experience, is what separates successful investors from those who merely speculate. Continuous learning through industry publications, real estate investing podcasts, and networking events is crucial for staying ahead of market shifts.

Moreover, the ‘investment in knowledge’ extends to the practicalities of homeownership and property management. Homeowners should understand the implications of different types of insurance, be aware of potential maintenance issues specific to their property, and proactively budget for repairs and renovations. For those who manage rental properties, knowledge of tenant-landlord laws, effective tenant screening processes, and strategies for maintaining positive tenant relationships are critical. These aspects of property management, when approached with diligence and a commitment to learning, contribute to long-term financial stability and the preservation of asset value. Effective negotiation tactics also come into play when dealing with contractors, tenants, or even when purchasing supplies.

Finally, the insights of Benjamin Franklin, while centuries old, underscore the enduring importance of informed decision-making in all aspects of real estate. Whether you are buying your first home, selling a property, or actively engaging in real estate investing, the principle of ‘an investment in knowledge pays the best interest’ remains paramount. By leveraging available resources, continuously learning, and seeking expert advice, you can navigate the complexities of the real estate market with confidence and achieve your financial goals, aligning with Franklin’s emphasis on prudence and strategic planning. This commitment to knowledge is the key to unlocking success in the world of real estate.”

Mind the Leaks: Budgeting and Financial Prudence

“Beware of little expenses; a small leak will sink a great ship.” Franklin’s emphasis on frugality translates directly to real estate, where seemingly minor costs can quickly accumulate and derail even the most promising property investment. For those focused on homeownership, this means more than just securing a mortgage; it requires a meticulous assessment of the total cost of ownership. Buyers must account for not only the principal and interest payments but also property taxes, homeowner’s insurance, potential private mortgage insurance (PMI), and the often-overlooked costs of routine maintenance and potential homeowner association (HOA) fees. Neglecting these ‘little expenses’ can strain budgets and lead to financial difficulties down the line. For example, a seemingly small increase in monthly HOA fees can significantly impact long-term affordability, especially for first-time homebuyers. Similarly, failing to budget for regular maintenance, such as roof repairs or appliance replacements, can result in large, unexpected expenses. From a real estate investing perspective, this principle is even more critical. Investors must factor in vacancy rates, property management fees, and potential repair costs when calculating cash flow. Overlooking these expenses can lead to negative returns and undermine the profitability of an investment property. Property management requires diligent tracking of expenses, ensuring that every dollar spent contributes to the overall financial health of the property. Sellers, too, must heed Franklin’s financial wisdom. While the goal is to maximize profit, it’s essential to carefully consider all associated costs. Closing costs, which can include title insurance, escrow fees, and transfer taxes, can significantly reduce net proceeds. Agent commissions, while often necessary for a successful sale, should be negotiated strategically. Additionally, staging expenses, while potentially increasing the sale price, must be balanced against their cost. A thorough financial analysis of all selling expenses is crucial to ensure a profitable transaction. Negotiation tactics play a key role here; understanding the market and your financial position allows for more effective bargaining. Creating a comprehensive budget and anticipating potential costs is not just a suggestion; it’s a necessity for both buyers and sellers. This financial planning, grounded in Franklin’s principles, can prevent financial strain and ensure a successful real estate transaction, whether it’s your first home or a strategic property investment. In the context of the real estate market, a small oversight in budgeting can indeed lead to significant financial setbacks. Therefore, a meticulous approach to financial planning is paramount for success in homeownership, property management, and real estate investing. By understanding and diligently managing both the large and small expenses, one can navigate the real estate landscape with greater confidence and financial stability. Embracing this aspect of Franklin’s financial wisdom is essential for long-term success in the world of real estate.

The Power of Preparation: From Pre-Approval to Property Staging

“By failing to prepare, you are preparing to fail.” Benjamin Franklin’s wisdom resonates deeply in the complex world of real estate. Preparation is paramount, whether you’re a seasoned investor, a first-time homebuyer, or a property manager overseeing a portfolio. Thorough preparation empowers all parties to negotiate from a position of strength, make informed decisions, and ultimately achieve their desired outcomes. For buyers, this translates to securing pre-approval for a mortgage, not just to understand their budget but also to present themselves as serious contenders in a competitive market. Defining needs versus wants is crucial from both a financial planning and a negotiation tactics perspective; knowing your non-negotiables helps streamline the search and prevents emotional decisions. In a hot market, being prepared to act decisively is essential. This might involve attending open houses prepared with pre-written offer templates and proof of funds or working with a buyer’s agent who can submit offers quickly. For sellers, preparation takes on a different form. Investing in a pre-listing inspection allows sellers to address potential issues proactively, strengthening their negotiating position and potentially expediting the closing process. Effective home staging, informed by current market trends, can significantly impact a property’s perceived value and attract a wider pool of buyers. Anticipating buyer questions by compiling a detailed list of property features, recent upgrades, and utility costs demonstrates transparency and professionalism. From a real estate investing standpoint, preparation extends to thorough due diligence. This includes analyzing property values, rental potential, and neighborhood growth projections, aligning with Franklin’s emphasis on knowledge as the best investment. Property management professionals benefit from meticulous preparation as well. Creating detailed property maintenance schedules, establishing clear communication protocols with tenants, and having contingency plans for unexpected repairs contribute to efficient property management and tenant satisfaction, mirroring Franklin’s focus on preventing “small leaks” that can “sink a great ship.” Moreover, in the realm of financial planning for homeownership, preparation means understanding the long-term costs associated with a property. This involves not just the mortgage, but also property taxes, insurance, potential HOA fees, and regular maintenance, aligning with Franklin’s emphasis on frugality. In essence, whether buying or selling, investing or managing, Benjamin Franklin’s emphasis on preparation serves as a cornerstone for success in today’s dynamic real estate market.

The Value of Time: Strategic Decision-Making in Real Estate

“Time is money.” Benjamin Franklin’s pragmatic observation rings especially true in the dynamic world of real estate. In real estate, timing is everything. Recognizing market trends, acting decisively on promising opportunities, and avoiding procrastination can significantly impact profitability. For buyers, delaying a purchase in a rising market can lead to higher prices, quickly eroding affordability and potentially pushing dream homes out of reach. Conversely, swift action in a buyer’s market can secure a property below market value, creating instant equity. This resonates with Franklin’s financial wisdom, maximizing returns by capitalizing on opportune moments. For sellers, a swift and efficient closing process minimizes carrying costs, such as property taxes, utilities, and mortgage interest, and maximizes returns. Staying informed about market dynamics and acting strategically is crucial for success in property investment. This involves understanding micro and macro economic factors, interest rate trends, and local market conditions. Leveraging resources like Zillow, Realtor.com, and local real estate associations provides valuable data for informed decision-making.

From a property management perspective, time is a critical resource. Efficient tenant screening, prompt maintenance responses, and streamlined rent collection processes contribute to positive cash flow and long-term property value appreciation. Delays in addressing maintenance issues can lead to costly repairs and tenant dissatisfaction, impacting both financial planning and property management success. Negotiation tactics also benefit from a keen awareness of timing. Whether negotiating a purchase price, lease terms, or contractor bids, understanding the market’s rhythm and the other party’s motivations can create leverage and lead to favorable outcomes. For instance, presenting a well-researched offer quickly in a competitive market can give a buyer an edge. Similarly, a seller can negotiate from a position of strength by understanding market demand and pricing their property strategically.

In the realm of financial planning, time plays a crucial role in building long-term wealth through real estate. The power of compounding returns, a concept Franklin understood well, emphasizes the importance of starting early and making consistent investments over time. For homeowners, understanding the long-term financial implications of homeownership is vital. This includes factoring in property taxes, insurance, maintenance costs, and potential HOA fees when budgeting and planning for future expenses. Timely mortgage payments and careful financial planning contribute to building equity and financial security.

Benjamin Franklin’s emphasis on frugality also applies to the time invested in real estate transactions. By thoroughly researching properties, neighborhoods, and market trends, both buyers and sellers can avoid costly mistakes and make informed decisions. This due diligence saves time and money in the long run, aligning with Franklin’s emphasis on prudent financial management.

Finally, recognizing the value of time in real estate underscores the importance of seeking expert advice when needed. Consulting with real estate agents, financial advisors, and legal professionals can provide valuable insights and guidance, saving time and potentially avoiding costly pitfalls. This reinforces Franklin’s belief in the value of knowledge and its application to practical matters like real estate investing and homeownership.

Conclusion: Embracing Timeless Wisdom for Real Estate Success

Benjamin Franklin’s wisdom offers a timeless compass for navigating the complex world of real estate. By embracing his principles of knowledge, frugality, preparation, and time management, both buyers and sellers can make informed decisions, mitigate risks, and achieve their real estate goals. His insights, though centuries old, remain remarkably relevant in today’s market, proving that sound financial principles transcend time. Franklin’s emphasis on knowledge, for instance, translates directly into the modern real estate investing landscape. Conducting thorough due diligence, understanding market trends, and assessing property values are crucial for making sound investment decisions. Just as Franklin diversified his investments, today’s real estate investors should consider diversifying their portfolios across different property types and locations to mitigate risk and maximize returns. This might include exploring residential rentals, commercial properties, or even REITs (Real Estate Investment Trusts). In property management, Franklin’s focus on frugality shines through. “Beware of little expenses; a small leak will sink a great ship,” he warned. This applies to property maintenance where addressing minor issues promptly can prevent costly repairs down the line. Efficient property management also involves careful budgeting, negotiating favorable contracts with vendors, and optimizing rental income. For homeowners, this frugality translates to smart home improvements that enhance value while minimizing expenses. Negotiation, a skill Franklin honed as a diplomat, is paramount in real estate transactions. Whether buying or selling, understanding the art of negotiation can significantly impact the final price. Preparing thoroughly, knowing your market, and being willing to walk away from a bad deal are essential negotiation tactics. Franklin’s adage, “Time is money,” is especially true in real estate. Recognizing market cycles and acting decisively can mean the difference between securing a profitable deal and missing out. For buyers, hesitation in a rising market can lead to higher prices and lost opportunities. For sellers, a delayed closing can incur unnecessary holding costs. Homeownership, a cornerstone of financial stability, also aligns with Franklin’s principles. Viewing a home as both a dwelling and a potential investment requires careful financial planning. This includes securing a manageable mortgage, budgeting for ongoing maintenance, and understanding the long-term implications of property ownership. By integrating Franklin’s timeless wisdom into their real estate endeavors, both seasoned investors and first-time homebuyers can navigate the market with greater confidence and achieve lasting financial success.