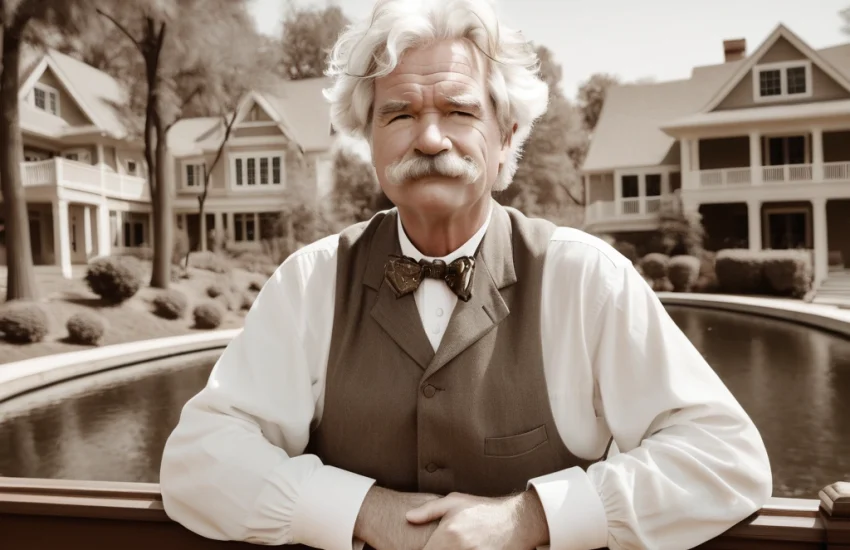

The Gilded Age of Real Estate: Mark Twain’s Timeless Wisdom

The Gilded Age, a term coined by Mark Twain himself alongside his collaborator Charles Dudley Warner, aptly describes periods of rapid economic growth often fueled by speculation and loose credit, much like the real estate booms witnessed in recent history. This era, spanning the late 19th century, saw fortunes made and lost on ventures built on shaky foundations, a scenario that echoes in today’s property market. While Twain’s satirical lens was focused on the excesses of his time, his observations on human nature and the allure of easy money resonate powerfully with today’s real estate landscape. Consider the dot-com bubble of the late 1990s and the subsequent housing market crash of 2008; both bear striking resemblance to the speculative fervor that Twain captured so vividly in his novels. These historical parallels underscore the timelessness of Twain’s insights and their relevance to understanding modern real estate investment. This article delves into the wit and wisdom of Mark Twain, applying his timeless insights to the complexities of modern real estate investment, market trends, and the eternal dance between buyer and seller. Twain’s keen observations about human behavior, particularly surrounding money and status, provide a valuable lens for navigating the often-turbulent waters of real estate. His writings, filled with humorous anecdotes and sharp social commentary, offer a wealth of wisdom for both seasoned investors and those just beginning to explore the world of property. From understanding the psychology of a buyer to recognizing the pitfalls of speculation, Twain’s wit and wisdom can illuminate the path to sound real estate decisions. For instance, his famous quote, “Buy land, they’re not making it anymore,” is often cited in real estate circles. However, a deeper dive into Twain’s work reveals a more nuanced understanding of land speculation, cautioning against the dangers of overpaying and emphasizing the importance of due diligence in property valuation. He understood that true value lies not just in scarcity, but also in utility, location, and market dynamics. This understanding is crucial for anyone looking to make wise real estate investment decisions. Mark Twain’s real estate quotes offer a treasure trove of wisdom for today’s investors, providing a humorous yet insightful commentary on the timeless principles of property market analysis. By examining his writings through the lens of modern real estate, we can gain a deeper appreciation for the cyclical nature of markets, the importance of due diligence, and the eternal dance between buyer and seller behavior.

Land Speculation: Twain’s Cautionary Tales for Modern Investors

Mark Twain’s often-quoted quip, Buy land, they’re not making it anymore, while seemingly straightforward, masks a deeper complexity regarding real estate speculation. This statement, frequently used to justify property purchases, particularly during periods of perceived scarcity, requires a nuanced understanding of Twain’s perspective. He witnessed firsthand the cyclical nature of boom and bust cycles, particularly in the American West, where land speculation often outpaced actual development and utility. Twain’s writings, such as The Gilded Age, offer a critical lens through which to view these periods of intense, often irrational, market activity, highlighting the dangers of unchecked optimism and the herd mentality that can drive prices to unsustainable levels. He understood that real estate value is not solely derived from scarcity but is also significantly influenced by factors such as location, accessibility, infrastructure, and the actual economic activity it supports. Twain’s insights serve as a powerful reminder that simply owning land does not guarantee financial success; its true value is dependent on a complex interplay of factors that require careful analysis and due diligence.

Twain’s era, much like our own, was characterized by rapid technological advancements and the emergence of new industries, which often fueled speculation in real estate. The promise of quick riches attracted many, often leading to a disconnect between perceived value and actual worth. In Twain’s time, this might have been seen in the railroad boom, where land near proposed lines saw rapid price inflation, often without any real economic foundation. Today, similar patterns can be observed in areas experiencing rapid technological growth or new infrastructure developments. Investors, therefore, need to be cautious of hype-driven markets where prices might be inflated beyond their true utility. Twain’s skepticism towards such speculative frenzies remains incredibly relevant, urging us to look beyond surface-level narratives and assess the fundamental drivers of real estate value. He would likely advise today’s investors to scrutinize the underlying economics of a potential investment, ensuring that it is not merely a product of speculative fervor.

Furthermore, Twain’s literature often portrays characters who are swayed by the allure of easy money, highlighting the psychological factors that drive speculative bubbles. His works serve as a commentary on human nature, demonstrating how greed and the fear of missing out can lead to irrational decision-making. This is particularly relevant in the context of real estate investment, where emotional biases can often cloud judgment. For instance, the fear of being left out of a rapidly rising market can lead investors to overpay for properties, ignoring fundamental principles of property valuation and market analysis. Twain’s characters, often blinded by the promise of quick profits, serve as cautionary figures, reminding us that a disciplined approach, grounded in facts and analysis, is crucial for successful real estate investment. Mark Twain real estate quotes, when viewed through this lens, offer more than just pithy sayings; they provide a deep insight into the pitfalls of speculative investment.

Modern investors can learn valuable lessons from Twain’s observations of 19th-century real estate speculation. His emphasis on understanding the true utility of a property, rather than relying solely on its scarcity, remains a cornerstone of sound real estate investment. This involves analyzing the property’s potential for income generation, its long-term prospects, and its sensitivity to economic cycles. A thorough property market analysis, incorporating factors such as location, demographics, and economic trends, is essential for making informed investment decisions. Furthermore, Twain’s skepticism towards manipulated data and overly optimistic projections encourages investors to critically evaluate market reports and claims, ensuring that their decisions are based on verifiable facts rather than hype. The timeless wisdom of Mark Twain continues to provide a valuable framework for navigating the complexities of real estate investment, urging us to be both cautious and discerning in our pursuit of financial success. The application of Mark Twain’s real estate investment wisdom is not just about avoiding losses but about making informed decisions based on a clear understanding of market dynamics and human psychology.

In essence, Twain’s insights extend beyond simple real estate advice; they offer a timeless perspective on the psychology of investment and the dangers of unchecked speculation. His works remind us that true value is not always readily apparent and that a disciplined, analytical approach is essential for navigating the complexities of the property market. Therefore, rather than simply relying on the adage, Buy land, they’re not making it anymore, investors should heed Twain’s deeper message: understand the market, assess the fundamentals, and avoid the pitfalls of speculative frenzy. This approach, rooted in careful analysis and skepticism, will lead to more sustainable and profitable real estate investment decisions. The lessons of Twain, when applied diligently, provide a valuable framework for both experienced and novice investors alike, ensuring that their investment strategies are grounded in reason and informed by a deep understanding of the market.

The Psychology of Real Estate: Twain’s Insights into Buyer and Seller Behavior

It’s easier to fool people than to convince them that they have been fooled. This Mark Twain real estate quote encapsulates a fundamental truth about the psychology of buying and selling, particularly in the often-turbulent property market. Real estate transactions are rarely purely rational; they are frequently driven by emotions, biases, and the persuasive power of clever marketing strategies. Both buyers and sellers are susceptible to these influences, making it crucial to approach property valuation and investment decisions with a critical eye. For example, a buyer might fall prey to the fear of missing out (FOMO), overpaying for a property based on perceived scarcity or the hype surrounding a new development, a scenario Twain would surely find ripe for satirical commentary. Similarly, a seller might inflate the value of their property based on emotional attachment or unrealistic expectations, ignoring objective market analysis.

Twain’s understanding of human nature, honed through his observations of the Gilded Age’s speculative frenzy, provides invaluable insights into real estate investment wisdom. He recognized that people are often more swayed by persuasive narratives than by cold, hard facts. This is particularly relevant in today’s market, where slick marketing campaigns and carefully curated data can easily manipulate perceptions. Consider the common practice of staging homes, a technique designed to evoke emotional responses and mask potential flaws. While not inherently unethical, this highlights how easily buyers can be influenced by superficial appearances rather than focusing on the underlying value and structural integrity of the property. Twain, a master of uncovering pretense, would likely advise investors to look beyond the surface and delve into the details, much like he did in his literary critiques of societal norms.

Moreover, the dynamics of buyer and seller behavior are often shaped by cognitive biases. Confirmation bias, for instance, leads individuals to seek out information that confirms their existing beliefs, potentially blinding them to red flags or alternative perspectives. A buyer convinced that a particular neighborhood is the next hot spot might ignore data suggesting otherwise, while a seller convinced of their property’s exceptional value might dismiss lower appraisals. These biases can lead to poor investment decisions and contribute to the cyclical nature of real estate booms and busts, a phenomenon Twain witnessed firsthand. He would likely emphasize the importance of independent verification and a healthy dose of skepticism as crucial tools for navigating the complexities of the property market.

Another aspect of the psychology of real estate, particularly in the context of property market analysis, is the tendency to follow the crowd. When prices are rising rapidly, and everyone seems to be making money, the temptation to jump on the bandwagon can be overwhelming. This herd mentality, fueled by FOMO and the allure of quick profits, can lead to irrational exuberance and ultimately contribute to market bubbles. Twain, with his keen eye for the absurdities of human behavior, would undoubtedly find this phenomenon both amusing and cautionary. His writings serve as a constant reminder that true investment success lies in independent thinking, thorough due diligence, and a willingness to go against the grain when necessary. He’d caution against blindly following trends and instead encourage a careful assessment of underlying fundamentals.

In essence, Mark Twain’s insights into the psychology of real estate serve as a timeless guide for navigating the complexities of the modern market. His observations about human nature, particularly our susceptibility to manipulation and our tendency to follow the crowd, are as relevant today as they were in the Gilded Age. By understanding these psychological factors and approaching real estate decisions with a healthy dose of skepticism, investors can avoid the pitfalls of speculation and make more informed, rational choices. Twain’s wisdom encourages us to be discerning consumers of information, to look beyond the hype, and to always question promises that seem too good to be true, a strategy that remains invaluable in the ever-evolving world of real estate investment.

Due Diligence and Avoiding Scams: Twain’s Practical Advice for Today’s Market

Twain’s famous line, Facts are stubborn things, but statistics are more pliable, serves as a stark warning in the often-murky world of real estate investment. In today’s data-rich environment, where market reports and property valuations are readily available, it’s easy to be swayed by carefully curated numbers. Twain’s skepticism encourages us to look beyond the surface, recognizing that data can be manipulated to paint a rosy picture, even when the underlying reality is far less appealing. This is especially relevant when evaluating property market analysis, where seemingly impressive growth percentages can mask underlying risks or unsustainable trends. For instance, a developer might highlight a 20% year-over-year increase in property values in a specific neighborhood, but fail to mention that this growth is primarily driven by short-term speculation or a temporary influx of buyers, rather than long-term economic fundamentals. Therefore, investors must be discerning consumers of information, looking beyond glossy brochures and carefully scrutinizing market reports, just as Twain would have advised.

Twain’s emphasis on independent verification is crucial. He would likely caution against relying solely on the seller’s provided property valuation or market analysis. Instead, he would advocate for obtaining independent appraisals and inspections, ensuring that investment decisions are based on verifiable data and not just wishful thinking. This could involve hiring a qualified appraiser to assess the true market value of a property, as well as engaging a home inspector to identify any potential structural or mechanical issues. These independent assessments can reveal hidden problems that a seller might be motivated to conceal, protecting the buyer from costly surprises down the road. Twain, a keen observer of human nature, understood the potential for manipulation and the importance of due diligence in any financial transaction, especially in the realm of real estate investment.

Moreover, Twain’s insights extend to the realm of real estate speculation. He witnessed firsthand the boom and bust cycles of the Gilded Age, where fortunes were made and lost on land speculation. He would likely view modern property flipping with a healthy dose of skepticism, urging investors to consider the long-term value and utility of a property, rather than simply focusing on short-term gains. He would also warn against the dangers of FOMO, or fear of missing out, which can lead to impulsive decisions and overpaying for properties. Twain’s wisdom reminds us that real estate investment should be approached with a rational and analytical mindset, not driven by emotion or the allure of quick riches. Just as he cautioned against the speculative frenzy of his time, his words resonate with the modern investor navigating the complexities of today’s real estate market.

Consider the example of a new development promising exorbitant returns. A modern-day Twain might advise potential buyers to look beyond the marketing hype and examine the underlying fundamentals. Are the projected returns realistic and sustainable? Is the location truly desirable, or is it simply being hyped up by developers? Are there hidden risks, such as potential environmental issues or zoning restrictions? Twain’s advice encourages us to question assumptions, verify claims, and rely on independent assessments, ensuring that our investment decisions are based on solid ground, not just wishful thinking. He would encourage investors to be as astute and discerning as a seasoned literary critic analyzing a complex text, uncovering hidden meanings and potential flaws. His approach to real estate investment would be rooted in a deep understanding of human nature and the inherent risks of speculation.

In essence, Twain’s perspective on real estate investment is a blend of practical advice and profound understanding of human psychology. He would advocate for a cautious and well-informed approach, emphasizing the importance of due diligence, independent verification, and a long-term perspective. He would also remind us that while real estate can be a valuable asset, it is not a guaranteed path to riches, and that the allure of easy money can often lead to disappointment. His timeless wisdom, gleaned from his observations of the Gilded Age, remains remarkably relevant in today’s real estate market, serving as a valuable guide for both novice and experienced investors alike. By applying Twain’s insights, we can navigate the complexities of real estate with greater confidence and avoid the pitfalls of speculation and manipulation.

Applying Twain’s Wisdom: Navigating Contemporary Real Estate Scenarios

Picture this: a gleaming new condominium tower rises against the skyline, promising luxurious living and astronomical returns. Brochures boast of breathtaking views, state-of-the-art amenities, and projected property values that seem to defy gravity. This scenario echoes the speculative fervor of Twain’s Gilded Age, where fortunes were made and lost on the promise of rapid appreciation. Twain, having witnessed such booms firsthand, would likely caution us with a wry observation, reminding us that projected returns are just that – projections, not guarantees. He might point out that true value lies not just in scarcity, as his famous quote suggests, but in the underlying utility and intrinsic worth of the property itself. Are the projected rental incomes realistic, or are they inflated by speculative hype? Is the location truly sustainable in the long term, considering factors like infrastructure, economic stability, and environmental risks? Twain’s wisdom encourages us to look beyond the dazzling marketing and analyze the fundamental economic realities. Due diligence, as Twain’s practical approach dictates, is essential. Just as he advised scrutinizing statistics, today’s investors should carefully examine market reports, comparable property values, and the developer’s track record. Beyond the glitz and glamour, what is the true substance of the investment? Consider also the psychology of the market. Twain, a keen observer of human behavior, understood that fear and greed often drive investment decisions. In a frenzied market, the fear of missing out (FOMO) can lead to impulsive purchases and inflated prices. Twain’s wit reminds us that a cool head and a healthy dose of skepticism are invaluable assets in navigating such scenarios. He might even remind us of his famous quote, “It’s easier to fool people than to convince them that they have been fooled,” urging us to be wary of slick sales pitches and promises that seem too good to be true. Conversely, in a buyer’s market, understanding the motivations of sellers can be advantageous. Twain’s insights into human nature suggest that sellers facing financial pressures or a declining market might be more willing to negotiate, presenting opportunities for discerning buyers to acquire properties below market value. His writings, filled with shrewd observations of human behavior, can serve as a guide for navigating the complexities of real estate transactions, reminding us to consider the emotional and psychological factors at play. Furthermore, Twain’s emphasis on careful observation and critical thinking applies to various real estate scenarios. Whether evaluating a potential investment property, negotiating a purchase agreement, or assessing market trends, adopting a Twain-like perspective can empower buyers and sellers alike to make informed decisions, avoid pitfalls, and navigate the ever-changing landscape of the real estate market with wisdom and humor. By applying Twain’s timeless insights, we can strive to achieve a balance between the allure of opportunity and the importance of prudence in the pursuit of real estate success.